Source: picture alliance / Getty

According to NBC4i, the Central Ohio Transit Authority has ended its bid Monday to place a 0.5% sales tax hike on the November ballot to help finance rapid transit lines, instead relying on other funding avenues.

COTA initially proposed the tax increase in April to make a dent in a proposed $8 billion transit plan – which includes constructing eight rapid transit corridors for busses by 2050 – but announced its decision to forego the ballot initiative Thursday, largely due to the state of Ohio’s economy.

“As we look at the economic climate and the reality of rising prices for gas, food, and more, we understand the financial strain these factors are putting on our community,” COTA spokesperson Jeff Pullin said in a statement. “Knowing this, we recognize now is not the right time to move forward with the public financing request for LinkUS.”

Officials estimated a 0.5% sales tax hike, which would raise the current tax from 0.5% to 1.0%, would tack on an extra $8.33 to central Ohio residents’ taxes every month, according to the LinkUS Community Action Plan, a transportation initiative co-sponsored by the city of Columbus, Franklin County, COTA and the Mid-Ohio Regional Planning Commission.

For the full NBC4 story click here

Get Breaking News & Exclusive Contest in Your Inbox:

The Latest:

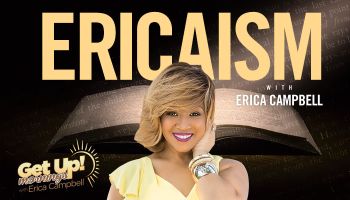

- Speaking Life and Aligning Words with God’s Promises | Ericaism

- Ohio Non-Profit Brings God To Public Schools

- The Blueprint For A Fantastic Future | Dr. Willie Jolley

- Preston Perry To Release Spiritual Book On ‘How To Tell The Truth’

- ‘Preachers of LA’ Returns To Air Wedding Of Bishop Noel Jones

- Susan Carol Signs to Def Jam Records

- How Ayurveda Can Help You Elevate Your Wellness Routine

- The Impact Of Courage On Your Success Journey | Dr. Willie Jolley

- Gospel Music Haus and Museum: A New Gospel Museum Is Headed To Houston

- Plug Into The Power | Faith Walking

Sales tax hike for Ohio rapid public transit dropped from November ballot was originally published on mycolumbusmagic.com